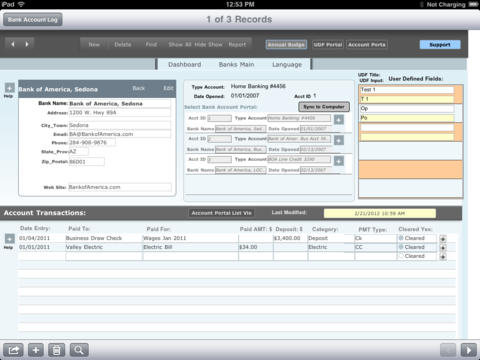

Bank Account Manager app for iPhone and iPad

Developer: Vaughn Clement

First release : 05 Mar 2012

App size: 1.92 Mb

Serious Apps for Serious Business

There are more than 21 iTunes apps available. For more detail information visit the developer support site. Support is always free. Request a live demonstration of this app online prior to buying the app. Most of my apps on iTunes are IOS 7 compatible. For information on IOS 8/9 redesign apps contact the developer for more information. (if you have any issues with this app contact the developer support site)

This app has screen Language text editing. You need to edit the app to change the field headers from the default English language to your language upon the initial download.

***In Sept 2014 the new larger size iPhone 6 is a game changer. At last you do not need to buy a separate tablet to have a larger screen. This will finally provide an iPad like experience on an iPhone. This will make all my apps more useful on this new iPhone.

***

Overview:

Why would I design a banking application for the iPad. I was looking for a special kind of program and could not find it, where I could do ”what if” reports. There are different products in the market, but most are full-blown accounting programs which was more than I really needed. I wanted something like a check ledger, but I wanted the ability and flexibility to have multiple accounts that I could fashion as required.

1. Have the ability to create any number of bank accounts that mimicked an accounting ledger. This ledger should only require minimum input, and also calculate summary totals.

2. The bank manager app will allow an unlimited number of ledgers where were any type of banking transactions could be added. A normal ledger is like a checkbook where you enter debits and credits and calculate the bank balance. This app needed to do more than a simple checkbook.

3. Ledger needed to collect data where credits and debits for transactions could be managed for any type of personal or business banking requirements. For example; if I wanted to collect data related to specific business activity like commissions, I could set up an account and monitor and manage sales commissions. Another example; if I wanted to track and monitor my home utilities such as; electric, gas, water, sewer, and any other month-to-month recurring costs, I could set up one account to do just this kind of activity. There are many of these types of management accounts for personal and business that I wanted to be able to track.

4. For businesses there are few applications that allow you to monitor and manage overhead expenses. This app needed to be able to create an account for overhead expenses and monitor all debits and credits related to the overhead expenses. This information would be used to assist management in defining misuse of overhead accounts, and to track and reduce spending waste by employees.

5. The goal of this application is to create the flexibility for managers or home users to better understand their bank finances.

6. Part of the managing of the bank account, is to also be able to budget both home and business accounts. The application should include a comprehensive budget tool that also had the flexibility to do what if forecasting. The app needed to be able to have an unlimited number of budgets defined by the user for comparison of different budgets. A master budget which would allow entry of data at any time for ongoing debits and credits was an essential part of the apps design.

7. One of the requirements of the budget would be to calculate monthly expenses, provide a list of items in a drop-down list of cost types, and to summarize all the cost types for that month. In addition to calculating the monthly expenses, the monthly income field would be used to calculate the monthly balance account were expenses would be subtracted from income to provide a budget balance for the month.